ATTIC spoke with Bernie Hankey at 2Compli who shares how relationships where formed with The Supervisors and technology providers, gaining a high level of understanding of the AML/CFT legislation and what is required to deliver compliant Risk Assessments, Programmes, Audits and training.

What being involved in the AML/CFT arena means to me

I feel incredibly lucky having lived in New Zealand for most of my life and have a desire to keep it a place that is known to be difficult for those who want to take advantage of others. This means ensuring that we do all we can to protect legitimate businesses from those who are involved in ML/TF. Curiosity and having a good understanding of how businesses operate are key. I like to think that every interaction I have with a customer they feel I have

added value to their day-to-day operations, and often I learn things from them that I can share to improve other clients processes.

Recognising red flags

Being a banker for many years involved in the payments arena, AML/CFT has been a key part of the many roles I held. I recall a situation about 9 years ago when I declined to take a 9-figure investment due to not being able to confirm the ultimate beneficial owner of the funds. I was called up by my Managing Director who wanted to understand my rational on

declining the opportunity. At the time we were all rewarded for obtaining new customers and investment funds so I was thankful that the MD supported me in the decision. Many others in the organisation wanted to accept the investment, and still probably don’t understand why it was the right decision.

The life of an AML/CFT Consultant

Fair to say that being an AML/CFT consultant you are often considered more of a hindrance than a help. Thankfully for many of the clients that we work with that stance does change. When audits and supervisor reviews have taken place, it is very satisfying to have clients return and ask for further guidance, training or support as they recognise the value that you have provided their business.

Often AML/CFT has been forced on you as a reporting entity. You may have picked up a template and used this to meet your AML/CFT requirements. We notice that reporting entities using templates have not taken time to really understand the risks that apply to their particular business. Sometimes the risks are rated high and this is appropriate for the type of business. By putting in place a practical programme with effective Policies, Procedures and Controls your AML/CFT journey becomes part of your everyday actions.

There are a number of instances where clients have shared their frameworks with others. That is all well and good providing they are updated for each reporting entity. There have been occasions where the framework documents have not even been updated with the business name, so quite an obvious gap to resolve.

An option I would suggest be considered is referring to the AML/CFT process as KYC. The more we know about our customers the more we can protect our business from being used for ML/TF purposes. If I collected $1.00 for every client who said to me, we know our customers really well and have no concerns that any are involved in ML/TF I would be a very wealthy person. A quick look through a customer file where it is not obvious what the transaction relates to is not an uncommon occurrence. Documenting nature and purpose goes a long way to completing the KYC view.

How do you keep up to date on changes in the industry?

- Obtain a qualification. I am a Certified Financial Crime Specialist (Through the Association of Certified Financial Crime Specialists). Although US based the information that they have available, courses, updates, and options to ensure continual professional development are vast. The global updates allow me to use these scenarios when working with our clients.

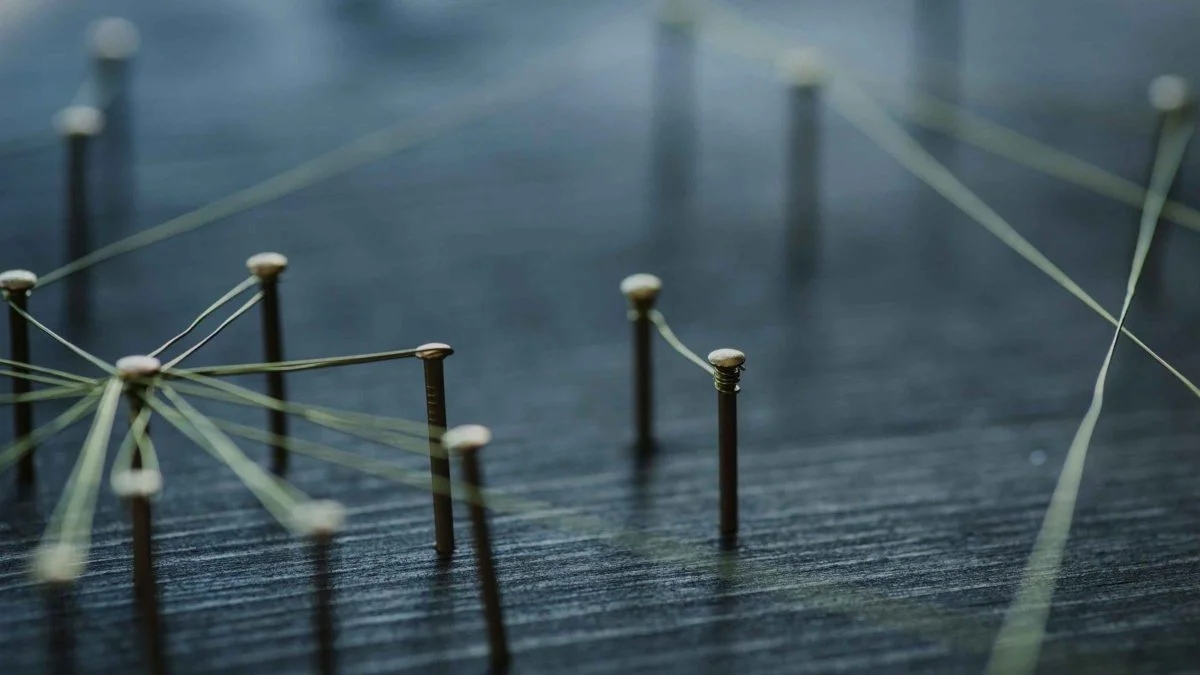

- Create a network. Often the AML/CFT guidance is not clear and open to interpretation. Rather then lead a customer down the wrong path talk it over with others you trust in the industry so you are confident you are giving a more informed view.

- Continually research the Supervisor sites as there are regular updates on what they are seeing in the market and updates to guidance materials.

What the future holds

It’s unlikely that AML/CFT will fade away. There are new channels, industries and opportunities, which will be used by criminals in innovative ways to launder funds and for terrorism financing purposes. Learning how these channels are used and identifying ways to mitigate risk are ongoing challenges. As technology changes, markets become more open, (after Covid) options to replace cash continue to appear, you can bet launderers will

find ways to beat the system, understanding these risks is therefore the key to combating them… this and having a friendly AML/CFT consultant close by.

Top Tips

Identify the risks in your business. If you were a money launderer, how could they use your business?

Integrate your AML/CFT framework into your business-as-usual activities.

Update your framework, don’t leave them on the shelf to gather dust.

Know your customer

Read more on AML consultancy in ‘how to choose the right AML provider‘.